NATIONAL FLOOD INSURANCE PROGRAM GENERAL PROPERTY POLICY COVERAGE ANALYSIS

(January 2019)

|

|

This coverage is provided by the National Flood Insurance Program (NFIP) under the Federal Emergency Management Agency (FEMA). It protects residential and commercial property owners against loss from flooding. The authority to offer this coverage is drawn from the National Flood Insurance Act of 1968. The policy refers to this act and states that the coverage relies directly upon the Act and its amendments. The Act has been modified over the years but the fundamentals of the program remain the same.

Note: This analysis is based on the NFIP October 2015 edition form. ISO has recently introduced a flood insurance policy for use by the private market that can be an alternative to the NFIP.

Related Article: ISO Personal Flood Policy Coverage Analysis

Introduction

The General Property form opens with a statement that coverage is barred from applying to either a residential condominium building or an individual condo unit (an exception is made for personal property). The exclusion merely makes this form dovetail with the program's dwelling and residential condo policy forms.

Related Article: National Flood Insurance Program Standard (Dwelling Form) Policy Coverage Analysis

I. Agreement

The insuring agreement obligates the policy to pay for direct flood losses that damage covered property. The coverage is contingent upon the policyholder having provided accurate underwriting (application and/or loss) information, compliance with applicable policy provisions and, naturally, payment of the policy premium. The policy is subject to review at any point of time and, if merited by such a review, the policy may be revised.

II. Definitions

The General Property Form defines the following terms in applying its coverages and provisions:

A. You and Your – the parties appearing in the policy’s declarations page. It also includes mortgagees and loss payees who appear on the application and declarations (). Mortgagees and loss payee who are not listed but can prove their financial interest in the covered property at the time of loss are also insureds.

We, Us, Our – refers to the insurer providing the flood coverage.

Flood – refers to:

1. Normally dry areas that have temporarily been covered in whole or in part by any of the following:

· Overflowing inland or tidal waters,

· An accumulation of water that is both rapid and unusual.

· Surface water runoff that comes from any source. (Heavy rains could be a source)

· Mudflows (a separately defined term)

However, the incident is a flood only if one or or both of the following occur:

· Two or more normally dry acres are inundated

· Two or more properties are inundated with at least one belonging to the named insured.

2. The collapse or subsidence of shores. However, the collapse or subsidence must be due to the action of flood-level water, such as erosion or be due to an waves or currents that exceeds anticipated levels due to overflow of inland or tidal waters

|

Example: The

residents of Grunge Village Shops were dismayed by the sight of water crashing

along their mall streets and into their businesses. They were even more

dismayed when they found out that the water damage was not covered by their

flood policies. The water was from |

|

Related Court Case: "Flood" Definition Clarified

B. The following are additional terms used throughout the policy.

1. Act

The National Flood Insurance Act of 1968 as well as any and all changes made to the Act since its introduction.

2. Actual Cash Value

The full replacement cost of an item, minus the amount of physical depreciation that exists at the time a covered loss (flood) occurs.

3. Application

The written statement the insured person completed and signed (or which has been signed by an agent) for the purpose of getting a flood policy and which the insurer relied upon to issue the coverage and to determine the policy premium.

Note: The application is considered part of the policy, so any inaccurate statements may, if discovered, either alter the premium or, more seriously, void coverage.

4. Base flood

This is determined by community or area. The flood that becomes the standard of measurement for a covered occurrence. Specifically, the flood that has a probability of one percent of being either equaled or exceeded during a given calendar year.

5. Basement

ANY area of a covered building that has a floor that is below ground level (subgrade) on all sides.

Note: It is important to understand that absolutely any area that is subgrade on all sides is, by policy definition, a basement; this applies even if the area is a sunken portion of a ground level floor or even if the area is completely “finished.”

|

|

Example: The

Ropers' home is a tri–level. The middle level, which holds the kitchen,

living room and family room, is about 4 feet under the surrounding land's

grade. The bottom level is even lower. The middle level and the bottom level

are both, based on the flood policy definition, basements. |

Related Court Case: "Basement" Definition Examined In Applying Exclusion To Insureds.

Related Article: Flood Glossary

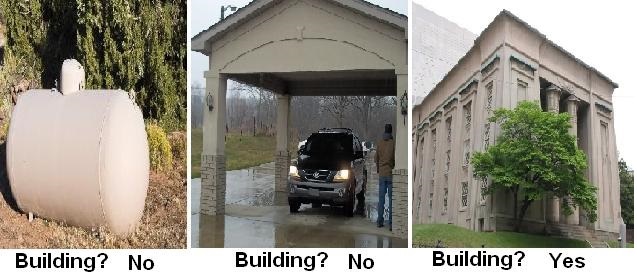

6. Building

As far as the flood policy is concerned, any of the following are considered building:

· A structure that has two or more rigid walls that are on the outside to which a roof is secured. It must be permanently attached to its site.

· A structure built on a chassis and transported to the site in one or more parts. When it arrives at its site it must be attached to a permanent foundation. This could be called either a mobile home or a manufactured home.

· A travel trailer on a chassis but attached to a permanent foundation. It cannot have wheels. It must be subject to an applicable community's floodplain and construction regulations.

It’s important to realize that gas or liquid storage tanks, recreational trailers as described above and recreational vehicles DO NOT qualify as buildings that are eligible for coverage under the flood policy.

|

Example: |

|

|

7. Cancellation

Coverage that terminates before the policy’s ending date.

8. Condominium

Any multi-unit residential structure where the single-units are individually owned and the group of owners share interest in the building’s outer structure and common property areas.

9. Condominium Association

An entity where all the members are individual unit owners, share interest in certain structures and rights in the use of certain property or areas and that membership in the entity is a requirement.

10. Declarations Page

The policy coverage page that summarizes the coverage provided by the policy and includes the identifying information on the insured and the covered property as supplied by the policy application.

The definition states that the declarations must be computer–generated, which means that handwritten or typed declarations would not qualify as declaration pages.

Note: This is an important fraud prevention step. Often flood is not desired until flooding is imminent so some individuals might be tempted to hand write or type declarations just before (or just after) a flood has occurred and back date it appropriately.

11. Described Location

The site that contains the structural or personal property that is covered by the flood policy. It must be shown on the declarations.

12. Direct Physical Loss By or From Flood

An insured property loss or damage that is caused directly by flooding. Physical changes to the property must be demonstrated.

13.

Any building with its lowest floor existing above the ground. The lowest floor may be supported by walls (foundation or shear), posts, piers or similar items. There can be no basement.

14. Emergency Program

The first phase for a community that has begun the process of joining the NFIP. Only limited flood coverage is available under the ACT during this (essentially a probationary) period.

15. Expense Constant

The policy expense fee portion of the flood insurance premium. The fee covers the government’s expenses that relate to flood insurance.

16. Federal Policy Fee

A fixed amount that is charged each policy term to pay for government flood program costs that are NOT covered by the expense constant. These are non-refundable.

17. Improvements

Any additional structural features that are part of a covered building.

18. Mudflow

A liquefied flow of mud that is

moving over normally dry areas, but it does not include other types of earth

movement.

19. National Flood Insurance Program

The flood coverage and land management program originally authorized and subsequently amended as the National Flood Insurance Act of 1968 and currently administered based on Title 44 of the Code of Federal Regulations, Subchapter B.

20. Policy

The set of documents including the actual flood policy, declarations page and application, as well as any endorsements or renewal certificates. Only the one building that is described in the application can be insured under a policy.

Note: This means that multiple policies are required for multiple buildings.

21. Pollutants

Any substance that is a solid, liquid, gaseous or thermal irritant or contaminant. Smoke, vapor, soot, fumes, acids, alkalis, chemicals or waste are all examples of such irritants/contaminants. The term waste includes not only disposed material but also materials that are to be recycled, reconditioned or reclaimed.

|

Example: The |

22. Post–FIRM building

A building that was started, built, or experienced substantial improvement after either 12/1/74 or the date that its community’s initial FIRM (Flood Insurance Rate Map) became effective. The later of the two dates apply.

23. Probation Premium

An additional flat charge that’s made every term for a policy when it is covering a property located in a community that has been placed under probation. In essence, it is a premium surcharge that results from any deficiency that created the probation action.

24. Regular Program Community

Any community that has a FIRM and has full flood coverage available at regular premiums.

25. Residential Condominium Building

A building that belongs to a condominium association IF at least 75% of the building’s floor area is residential.

26. Special Flood Hazard Area

An area that is particularly vulnerable to flood damage AND which is designated with a special zoning code on either a Flood Hazard Boundary Map (FHBM) or a FIRM.

|

Special Flood Hazard area (zones) |

||

|

A |

A1–30 |

A99 |

|

AE |

AH |

AO |

|

AR |

AR/A |

AR/A1–A30 |

|

AR/AE |

AR/AH |

AR/AO |

|

V |

VE |

V1-V30 |

Note: Special Flood Hazard Area Zone VO no longer appears.

Related Article: National Flood Insurance Program Glossary.

27. Stock

Finished, in-process or raw materials (including supplies) that is in storage. It may be intended to be sold. . Items that are listed as Property Not Covered are not covered as stock except for the following:

·

Self-propelled vehicles parts

and equipment (but not the vehicles themselves)

·

Watercraft furnishings and

equipment (but not the watercraft itself)

·

Spas, hot tub and equipment to

be used with either

·

Equipment used with swimming

pools (but not the swimming pools)

28. Unit

A single nit that is part of a condominium building.

29. Valued policy

A policy that has a limit of insurance that was determined as a mutually agreed-upon amount to be paid if the insured suffers a total loss.

Under this definition the statement is made that “The Standard Flood Insurance Policy is not a valued policy.”

III. Property Covered

A. Coverage A –

Building Property

This section describes the type of structural property that qualifies for coverage under the general property flood policy. Direct physical damage loss to the following items are covered but only if the damage is due to flood.

1. The building must be described in the policy's declarations and exist at the location described in the declarations. If the described building is a condominium and the named insured is the condominium association then all of the units within that building are covered but only those that are commonly owned. Improvements within the condominium units are also covered.

2. Building property that has been moved to another location in order to protect it from flood loss (as described in III.C.2.b) is covered at that location for a maximum of 45 days.

|

|

Example:

Klamsdale Bakery is covered by a General Property Flood policy. On June 10th,

the business district where the bakery is located experiences flooding from

an overflowing river. Klamsdale's owner moves a new, 14-Pan Proof Box out of

the bakery to a friend's storage area. That equipment will remain eligible

for coverage at the temporary location until July 24th. |

3. Additions and Extensions

Parts of an eligible building that have been added or that extend the property can be covered as part of the building to which they are attached or as a separate structure. This option is available only IF the addition or extension is connected by a rigid exterior wall, stairwell, roof, elevated walkway, or load-bearing interior wall. If the addition/extension is connected by a non-load bearing interior wall, it is part of the building to which it is connected and may not be separately covered. The ability to separately insure an extension could be important if the maximum coverage available is not enough to cover both the extension and the building to which it is attached.

4. Fixtures, Machinery and Equipment

This portion of Coverage A extends coverage to the following:

|

Awnings/Canopies |

Central Air Conditioners |

Furnaces |

Antennas/aerials attached to buildings |

Permanently installed mirrors |

|

Blinds |

Elevator Equipment |

Freezers – Walk-in Type |

Pumps and accessories |

Permanently installed cabinets, bookcases, cupboards, paneling and wallpaper |

|

Carpet (IF installed over unfinished flooring) |

Fire Extinguishing Devices (including sprinklers) |

Light Fixtures |

Ventilating equipment |

|

Other items eligible for coverage as building property are built-in dishwashers, microwave ovens, garbage disposals, water heaters, cabinets, plumbing, radiators, ranges, refrigerators, ands stoves IF they are installed in a unit that is located in a covered building.

5. Materials and Supplies

When such property is intended for building onto, or repairing the covered building, it also qualifies for protection against flood damage. However, the protection exists ONLY IF the material is stored in an enclosed building that MUST meet the flood policy’s definition of “building.” The materials must be in an eligible building that meets either of the following requirements:

· Located at the covered address

· At a location that’s next to the covered address.

6. A building in the course of construction before it is walled and roofed may qualify for coverage if the loss occurs during the time that work is being performed on the structure. This exception exists even when work is temporarily halted but that interruption can be for no more than 90 days.

This item does not apply to all structures. If the lowest floor in a non-elevated building or the lowest elevated floor of an elevated building does not meet the following criteria, the building is not covered until it is walled and roofed.

The criteria are determined by flood zone.

|

A |

A1–30 |

A99 |

Must not be below the base flood elevation |

|

AE |

AH |

AO |

|

|

AR |

AR/A |

AR/A1–30 |

Must not be below the adjusted wave action effect base flood elevation |

|

AR/AE |

AR/AH |

AR/AO |

|

|

V1–30 |

VE |

V |

Limitation does not apply |

Related Article National Flood Insurance Program – Glossary of Terms

7. A manufactured home or travel trailer

Such property is eligible for coverage; however, special restrictions apply when the property is located in areas designated as especially vulnerable to flooding. The property must be anchored based on one of the following:

· Using over-the-op or frame ties to ground anchors

· According to the specifications of the manufacturer

· Based on the community’s floodplain management requirements. This item is waived if the building has been continuously covered under the NFIP since 9/30/82.

8. Property Located in Lower-Levels

a. Certain items that are located in basements or in the lowest level of an elevated post-FIRM building qualify for coverage. Eligibility depends on whether the property is installed where functionally intended and, if applicable, is connected to a proper power source. The eligible property includes:

|

Cisterns and sump pumps |

Drywall for basement |

Central Air Conditioners |

Junction and breaker boxes |

|

Electrical outlets/switches |

Newer elevators, dumbwaiters and equipment |

Fuel, fuel tanks |

Furnaces, water heaters |

|

Heat pumps |

Nonflammable insulation |

Solar energy system pumps/tanks |

Attached stairwells/stairways |

|

Water softeners, filters and faucets |

Well water tanks/pumps |

Utility connections |

Foundation structures that support a covered building |

Note: The limitation applies only if the elevated post-FIRM

building is located in one of the following zones – A1-A30, AE, AH,

b. Coverage also extends to related clean-up costs involving the

above items.

COVERAGE B –

Personal Property

This section concerns personal property.

1. Personal property is eligible for coverage when either of the

following apply:

a. It is owned by the named insured. If the named insured is a condominium association, personal property must be owned by the association and used solely for condo association activity

b. The unit-owners in a condo association own it in common.

|

Example: The

Flufferville Condo Association has two personal property items listed among

their flood damage property: a popcorn machine and a mahogany wardrobe. The

popcorn machine is owned by the association. The wardrobe is jointly owned by

all unit-owners. After a loss investigation, the damage to the popcorn

machine is not paid, while the wardrobe loss is. As it turns out, the popcorn

machine was rented out to local non-profits for their fundraisers. This was

not considered condo association activity. The wardrobe was covered even

though it was used to advertise a single condo member’s furniture store

because there is no requirement that jointly owned property be used solely

for condo association activity. |

|

Eligible personal property that has been moved to another location in order to protect it from flood loss is covered at that location for a maximum of 45 days.

2. Selection of covered personal property

When the general property policy covers personal property, the insured must make a choice. The form may either protect household personal property or business personal property. The policy's protection is mutually exclusive. Further, in order to qualify for coverage, such property must be within a covered building.

a. If household property protection is selected, coverage applies to property belonging to the named insured, the named insured's family and, at the named insured's discretion, similar property that belongs to guests or domestic workers. Other eligible property includes items for which the named insured has a legal obligation to protect. The coverage maximum is controlled by the policy’s insurance limits.

b. If "other than household" property protection is selected, then coverage applies to furniture, fixtures, stock (as defined in the policy), machinery, equipment and other business-related property owned by the named insured.

Note: The other business-related property is subject to the policy’s Property Not Covered Section.

3. Property eligible for coverage under the General Property Policy

includes:

|

Ovens, ranges, and similar appliances |

Air Conditioners (installed within the covered building) |

Washing Machines |

Dryers |

Cook-out Grills |

|

Freezers (except walk–in freezers) |

Outdoor Furniture and equipment - IF stored inside a covered building |

Portable Dishwashers and Microwave ovens |

Carpets-not Permanently Installed |

Frozen Food |

|

Example: Fiona's Health Togs is insured under a General Property Policy. She chose to protect her business personal property. During the policy period, flooding destroys most of her personal property. Specifically, she suffers the following losses: |

||

|

Item |

Located |

Covered? |

|

Fax/copier |

Inside store |

Yes– business personal property |

|

Window Unit Air Conditioner |

In window of exercise room that's attached to her store |

No–doesn't qualify as business personal property |

|

Warm up suits on a portable rack |

On sidewalk outside of store |

No–was not kept inside a covered building |

4. Personal Property Located in Lower-Levels

Certain items that are located in basements or in the lowest level of an elevated post-FIRM building qualify for coverage. Eligibility depends on whether the property is installed where functionally intended and, if applicable, is connected to a proper power source. The eligible property includes air conditioners that are portable or window units, washers, dryers, food freezers that are not walk–in models and frozen food that is kept in a covered freezer.

Note: When not located in a basement, lowest level property is

eligible only when located in buildings in zones A1-A30, AE, AH,

5. Special Limits

The General Property Policy has a modest $2,500 limit for certain types of high-value, highly vulnerable personal property. The $2,500 amount is the maximum that will be paid for any flood damage involving artwork, rare books, autographed items, jewelry, watches, precious metals, any article in which fur is the principal value of the article, collectibles/memorabilia (sports cards, comic books, etc.)

|

Example: Andra Well-off suffers the following loss (and settlement): |

||

|

Item |

Value |

|

|

A first edition of Moby Dick |

$600 |

|

|

An ermine-trimmed belt |

$300 |

|

|

A jade necklace |

$1,900 |

|

|

A (miniature) self-portrait of Toulouse-Lautrec |

$3,200 |

|

|

Total |

$6,000 |

|

|

Total Settlement |

$2,500 |

|

6. Antique Limitation

For all intents, antiques are treated the same as regular property. The General Property Policy pays losses involving such property according to its functional value.

|

Example: Jerry loses two file

cabinets during a recent flood. Both were the same size. Cabinet one was

bought last month from OfficeWorld for $85 and the other was handed down from

his grandparents. It was built circa 1900 and was last appraised at $2,300.

His policy paid him $80 apiece. |

7, Improvements – Tenants

Tenants who make structural improvements to a covered building even though they will not be allowed to remove the improvements, may use a maximum of 10% of their personal property coverage limit to cover those improvements. Any amount used to protect an improvement reduces coverage available for other personal property.

8. Coverage Extension –

Condo Unit Owners

Insureds who are single-unit condo owners can use a maximum of 10% of their personal property coverage limit to handle losses to interior walls, floors and ceilings. However, any amount used in this manner reduces the amount available on a given claim.

Note: This option is not available when the described property is protected by a condo building policy issued to a condo association.

9. Enclosed Property –

Tenants

In order to qualify for coverage, tenant-owned property must be located within an enclosed building.

|

|

Example: In a recent

flood loss to the apartment building when Lucy lives, she also lost a set of

patio furniture worth nearly $400. Because this property was located on her

first-floor apartment patio, it is not eligible for coverage. |

Coverage C – Other Coverages

The General Property Flood Policy offers additional coverages.

1. Debris Removal

Losses normally include many instances of insured property being covered in debris. Coverage C’s coverage intent is to reimburse an insured for the expense of picking up and disposing of the debris. The coverage will pay for handling:

· Any foreign (not owned by the named insured) debris that is laying on the described premises

|

Example: 90% of

a wall belonging to John’s neighbor’s

home is now on John’s front lawn. |

· Debris of insured property wherever it may be

· The labor cost of an insured or insured household who performs any debris removal. The payment is according to the applicable, federal minimum wage.

This is not additional insurance. Any payment made under Coverage C reduces amounts available to pay for losses under Coverages A and B.

2. Loss Avoidance Measures

This coverage reimburses the named insured for the following expenses related to mitigating or preventing a flood threat. These are not additional amounts of insurance but are sublimits that reduce the limit of liability available to pay for flood damage.

a. Sandbags, Supplies and Labor

A maximum of $1,000 if available for the cost of sand bags; fill materials to create a temporary levee; pumps; plastic sheeting, lumber and the related labor costs. The labor costs use the prevailing federal minimum wage in determining the value.

The policy requires that the insured building actually face possible flood damage. In order to be reimbursed, the local authorities must have issued an evacuation order or the area around the covered location and the location must have evidence of flood damage.

Editor's note: The additional requirements seem somewhat strict considering that its purpose is to encourage mitigation, the coverage amount is very modest and any reimbursement reduces the policy's available coverage limit.

b. Property Removed to Safety

The policy also provides a maximum reimbursement of $1,000 for expenses related to removing eligible property from a location that is threatened by flooding. The cost of moving a moveable home is included in this item. The property that has been removed is eligible for coverage away from the described location for up to 45 days from the removal date. However, the new property location must either be above-ground or out of any special flood hazard area (as defined by the policy).

3. Pollution Damage

This coverage has a limit of $10,000. However, any payment reduces the policy's coverage limit. It responds to loss caused by pollutants that are released from the described location due to flooding. It is a first party coverage, applying only to pollutant damage to covered property.

|

Example: Marvin's Mower and Lawn

Equipment Repair Shop is covered by a General Property Policy. His limit

under Coverage A is $162,000. A flood occurs and inundates his premises.

Besides water damage to his shop and to the contents he wasn't able to move

(before evacuating), the flood also caused several barrels of degreasing

solvent to rupture. The $4,000 in damage that it causes to his shop is paid,

but the $5,500 of damage the released degreaser inflicts on two neighboring

businesses is not eligible for payment. |

|

Note: This coverage does NOT extend to costs an insured faces to test for or monitor the presence of pollutants unless the insured must do so to comply with either a law or ordinance.

Related Court Case: Court Bars Suit For Damages To Contaminated Home – this is not a flooding event, but it does illustrate a how a polluting event can create a significant HO loss.

Coverage D – Increased Cost of

Compliance

1. General

The General Property Flood Policy provides coverage to address some costs incurred to conform to state and local requirements involving repairing or rebuilding covered property that was damaged or destroyed by flood. Any payment is required to be related to qualified activities such as floodproofing, relocation and demolition. These activities are covered ONLY for residential structures that have acceptable basements as defined in the FEMA regulations and for nonresidential structures.

2. Limit of Liability

If and only if a flood policy includes protection under Coverage A, a total of $30,000 is provided under this provision to handle flood program compliance issues. The compliance costs must be associated with requirements under the flood act and the $30,000 maximum applies regardless how it may be provided under Coverage A and or Coverage D. No deductible applies for a Coverage D claim.

3. Eligibility

a. A qualifying structure must meet a number of NFIP program requirements.

(1) It must qualify as a repetitive loss structure. Besides being covered under a NFIP policy, it must have suffered covered flood losses a minimum of twice in the ten years immediately prior to the last reported claim. In addition, the following must be met:

· The previous loss amounts must have, at least, been equal to 25% of the covered structure's market value

· The community where the losses occurred must be enforcing a law that is equal to the cumulative or substantial damage provision that is encoded in its floodplain management law

(2) If not meeting the standards under a. (1), a structure that experienced flood damage equal to or greater than 50% of its market value. The market value used is based on the value of the structure at the time of the previous flood loss. Again, a state or community must be exercising its own cumulative or substantial damage provision against the structure.

b. Coverage D will also pay for compliance expenses to meet the NFIP’s minimum standards as stated in the Code of Federal Regulations. Payment may also be made for expenses to meet standards that are higher than those required by NFIP regulations if they exceed:

(1) The standards listed above in item 3.a. (1)

(2) The increase in cost of elevation or floodproofing that is needed to have a damaged home comply with FEMA base flood elevations in any risk zone. However, the cost has to be the result of a state or community adopting and enforcing the FEMA recommendations. This exception includes situations where elevations which are being increased in zones B, C, X or D, are being switched to base flood elevations UNLESS the elevations are derived by the state or community instead of elevations recommended by FEMA.

(3) The increase in costs of elevation or floodproofing that is needed to have a damaged home EXCEED FEMA base flood elevations IF it is done to comply with state or local “freeboard” (required height of construction above expected water level) requirements.

Coverage D will also pay the additional costs (subject to its insurance limits) when c. and/or d. below apply:

c. The increased cost is created in an unnumbered A zone where the elevation or floodproofing is done to comply with the base flood elevation recommended according to federal, state or local elevation data;

d. The incremental costs of elevating or floodproofing to meet state or local floodplain management laws after a covered structure has been demolished or relocated and the costs are incurred while the structure is being rebuilt either at the same site or at another site

Note: Item d. is subject to Exclusion D.5.g. below

e. Payment may also be made to help with compliance costs for rebuilding a structure at an elevation that meets the applicable community's base flood elevation. Payment is also made in instances where a damaged or destroyed home that previously received a variance (an exception or waiver) must now conform to local or State standards.

|

Example: The Oldenville Furniture

Mill, built in 1973, was heavily damaged by a flood and must be rebuilt.

Oldenville entered the regular NFIP program in 1990. Because of the age of

the Mill and the fact that it had been maintained so well by its owners, the

Oldenville Town Board granted the Mill a variance, so it didn't have to raise

the level of its site. Now that the Mill has to be replaced, the board is

requiring it to bring its site into compliance at an added expense of

$23,000. The Mill's General Property Policy will respond to this additional

cost. |

Related Article: NFIP Flood Zone Explanations

Focus on Repetitive Loss Structures: In July 2003, Congress passed H.R. 253, titled “Two Floods and Your Losses Are Out of the Taxpayers’ Pocket Act.” The legislation was passed in response to the fact that, although repetitive loss structures are a small percentage of those that are vulnerable to flood loss, the class loss experience is disproportionate. Rather than take advantage of procedures meant to reduce the chance of future loss, such owners often just depend upon flood coverage to handle any damage. The Act provides an incentive to take mitigating action, such as elevating or moving the structure. If recommended action is not taken, property owners risk the chance or paying much higher flood insurance premiums or face the loss of flood insurance and/or federal disaster assistance.

Related Article: Repetitive Loss Properties

4. Conditions

This section contains a fairly straight-forward explanation of a couple of stipulations involving loss payments under Coverage D – Increased Cost of Compliance.

a. A covered structure must suffer direct damage from flooding. The flood loss must be accompanied by an increase in claim costs. The increased cost must be due to the enforcement of a law or regulation involving floodplain management. The items eligible for coverage include increased costs to:

· Elevate

· Floodproof

· Relocate

· Demolish (including clearing the site, discontinuing utilities and properly abandoning utilities located on the loss site), a covered structure including any combination of the above activities.

b. The building that is rebuilt or repaired must have the same use and occupancy as the building that was damaged or destroyed UNLESS a change is made because of an ordinance or law.

|

Example: Klara's

Klericals, a small temp worker service housed in a three thousand square foot

office, was substantially damaged by flooding. A town ordinance required her

to tear down the remaining part of her office and rebuild. Klara did so and

her new office was completed a few months after the flood loss. Klara's flood

policy would have covered the additional cost caused by the demolition

expense except that instead of rebuilding it for her prior occupancy she

changed the layout so it could support her new business, Klara's Kiln, a

pottery shop. |

|

5. Exclusions

This section explicitly states that it refers to Coverage D – Increased Cost of Compliance. This may seem insignificant, but it certainly aids the understanding of the provision and should be used in the other provisions. Regardless, there is NO COVERAGE for costs created by authorities enforcing:

a. Community floodplain management laws or ordinances. This exclusion

applies only to communities under the NFIP Emergency Program.

Since the flood coverage in such communities is limited, it is logical to restrict strained insurance resources to covering direct losses.

b. Pollution related regulations that mandate an insured to do any of the following related to the impact of pollutants:

· Test for

· Clean up

· Monitor

· Contain

· Treat

· Detoxify

· Neutralize

· Respond to

· Assess

Note: The general property flood policy uses the same description of pollutants that is found in standard ISO property and casualty insurance policies.

c. A loss in value to any

covered structure or building when compliance with flood regulations creates

the reduction.

|

Example: the

Brendreds were in the midst of selling their coastal home when it is severely

damaged by flooding. When repaired, they were required to adjust the elevation

and install barriers. The changes improved their property’s ability to weather

future floods but ruined their view. Their realtor estimates they lost

roughly 40% of what they could have received when they finally were able to

sell their home. The Brendreds, while suffering an additional loss related to

the flood, will not be able to recover the loss of property value from their

flood policy. |

|

d. The loss of residual value of the undamaged portion of a covered

structure that must be demolished or relocated because of complying with a

flood regulation.

e. The Coverage D compliance costs will not be paid unless both the

following conditions are met:

(1) Until the covered building actually undergoes the required

elevation, floodproofing, demolition or relocation

(2) The required compliance activity takes place within a maximum of

two years from the loss date.

Note: This is really more a condition than an exclusion.

This is quite a logical exclusion. The insurer is not obligated to pay for activity that either doesn’t actually take place AND doesn’t take place in a timely manner. This protects the insurer against paying for either unnecessary costs or, due to prolonged delay, for unnecessarily increased compliance costs.

f. Any code upgrade requirements that are not part of a state or local

floodplain management law or ordinance.

This concerns updating a structure’s plumbing, electrical system, etc. that may be required in various ordinances or laws but that are not specifically flood related.

|

Example: Ned has just finished

rebuilding his package storage business. He experienced some additional

costs. Besides having to elevate the building to comply with his community's

flood plan provisions, he also had to strip out the building’s ancient copper

plumbing and install PVC pipes. This additional, non-flood compliance cost is

not eligible for coverage. |

|

g. If an improvement or addition is made following a flood loss, the costs needed to bring that improvement or addition into compliance with a state’s or local community’s floodplain management laws or ordinances is excluded.

h. Loss due to any ordinance or law that the insured was required to

comply with before the current loss.

|

|

Example: Carl's

pizza shop was flooded by Happytown's creek overflowing its banks due to

winter ice/snow runoffs. The Write Your Own insurer that handled his flood

coverage deducted several thousand from his settlement when it discovered

(from Carl), that he was supposed to comply with some of those local flood

ordinances the previous year but had not. |

i. Any rebuilding activity that fails to pass NFIP minimum standards,

including receipt by the insured of a

state or community variance to rebuild flood damaged property at an elevation

below the base flood elevation.

In other words, even when a policyholder suffers a serious loss which includes a requirement to improve the structure to meet local flood standards, but not the minimum standards set by the NFIP, the general property policy’s Coverage D will not cover the increased cost. This exclusion applies even when the policyholder has a variance from having to meet the higher standard.

It would appear that this exclusion would come into play under rare circumstances. However, there may be an instance such as the following.

|

Example: Lowlee

Grocers suffered flood damage equal to 65% of the current market value of his

store. Circle-land’s anti-flood regulations required him to elevate and

floodproof his building according to Circle-land’s independently derived

standards, which were below the NFIP standards. Lowlee’s flood policy has

Coverage D limits of $10,000. The increased cost to comply is $8,000 to meet

Circle-land’s standards and $12,000 to meet the NFIP standards. Lowlee

decides to avoid out of pocket costs that would be created by meeting NFIP

standards and rebuilds his store according to Circle-land requirements.

Lowlee is shocked to discover that, since his compliance efforts do not meet

NFIP standards, he’ll have to handle the entire $8,000 as out-of-pocket

expenses. |

j. Increased Cost of Compliance for garage or carport

There is no protection under Coverage D for increased costs to bring carports or garages in compliance with state or local ordinances.

k. Any instance involving property that is protected by a Group Flood Insurance Policy issued pursuant to 44 CFR 61.17.

Simply, any structure insured under the specified group policy is not eligible for protection because that would result in duplicate coverage.

l. Either condominium association or individual condominium unit-owners assessments that are made for handling additional costs of repairing post-flood damage to commonly owned buildings.

The

exclusion applies to such costs related to having to conform to state or local

floodplain management ordinances or laws.

|

Example: Jan Cubbihole was still in the

process of getting her salon back in order after suffering a big flood loss

when she got a notice from her Mall Association. Leekalot Shoppes is

assessing all of the store unit owners for damages to the |

One might argue whether this is a fair exclusion, say in the instance where all of the condo association members have paid for an adequate amount of coverage under Coverage D – Increased Cost of Compliance. However, the exclusion is, at least, consistent with the policy’s approach to bar the ability of a condo association to get coverage via individual condo owner flood insurance policies.

6. Other Provisions

This item is a notice that all of the policy’s remaining conditions and provisions apply to Coverage D.

IV. Property Not Covered

This section clarifies some types of property and situations that are not eligible as covered property. The general property policy does NOT COVER:

1. Personal property that is in the open.

If the property is not in a building, it isn’t covered. This portion of the provision is pretty logical because such property is very vulnerable to loss and is also highly portable; an insured should be encouraged to protect such property by moving it into a fully enclosed building.

2. A building and personal property located in the building when the structure is either in, on, or over water is ineligible for coverage. Further, if a building is located seaward of mean high tide, it also fails to qualify for protection. IMPORTANT – this exclusion applies only to such buildings that were either newly constructed or substantially improved on or after October 1, 1982.

3. Damage to open structures and damage to personal property located in, on, or over water. Boat houses and structures in which floating boats are kept or stored are also ineligible.

4. Recreational vehicles are barred from coverage. Their ineligibility is not affected by whether they still have wheels or are a part of a permanent foundation. However, travel trailers that are within the definition of building in II.B.6.c, are covered.

5. Any self-propelled vehicle or machine and motor vehicle including their parts and equipment. There are two exceptions. When they are inside the building, motorized equipment pertaining to the service of the described unit or building or that are designed to assist handicapped persons are covered.

6. Land and its value is not covered. Living, growing property such as lawns, trees, shrubs, plants, and crops are ineligible. In addition, animals are not covered.

7. Valuable papers and currency such as manuscripts, accounts, bills, currency, deeds, evidences of debt, money, as well as medals, postage stamps, securities, bullion, and similar property including records.

8. Wells, septic tanks, septic systems, and all other underground structures and equipment are ineligible property

9. Surfaces that lie outside a covered property’s perimeter walls are not insured. Examples are walks, walkways, deck driveways, patios, and other surfaces) are not affected by their type of construction nor by whether they are covered.

|

Example: Fanny's apartment building

was flooded along with the rest of her part of town. Unfortunately, this

occurred a day after she just had a new cement sidewalk poured. The loss of

$2,500 in cement work is not covered. |

10. Any type of container and its related equipment. Examples of such containers are gas or liquid tanks.

11. Property below ground, meaning a building or unit and its contents, including personal property and machinery and equipment.

Underground homes or structures, including contents, are not covered by the general property policy if slightly half or more of the structure’s actual cash value is located below the base flood elevation or the adjacent ground level; this is depending upon whether the home is part of the Regular or Emergency Flood Program. This exclusion does not apply in instances where a building has used earth in an approved manner for insulation. An insured would have to have documentation to prove that the building and insulation installation met with building construction and energy conservation standards as well as with the NFIP’s applicable elevation requirements.

Note: This exclusion is an all-or-nothing premise. If the structure’s features cause it to fail to qualify for coverage, then ALL of the accompanying structures and contents are ineligible.

12. Other structural property that is ineligible for protection includes fences, retaining walls, seawalls, bulkheads, wharves, piers, bridges and docks.

13. Aircraft and watercraft are not covered and the exclusion extends to related furnishings and equipment.

14. Other ineligible property includes hot tubs, pools, spas and there plumbing. This does not apply to such items when a part of a bathroom.

15. No protection applies to property barred from coverage under the Coastal Barrier Improvement Act and the Coastal Barrier Resources Act.

16. No coverage is available for property that belongs to a condominium unit owner that falls outside of the types referenced under Coverage B – Personal Property.

17. A residential condominium that is located in a community covered by the NFIP Regular Program (as defined) is not eligible for coverage.

V. Exclusions

A. The General

Property Policy will not compensate, reimburse an insured, nor provide an

allowance for:

1. Lost revenue or profits

This is clearly an extension of the previous exclusions of coverage for indirect losses. The ultimate reward for any business activity is the portion of any income that exceeds the cost of generating the income. There is no opportunity under the flood policy to be reimbursed for potential profits that are lost because of a covered event.

2. Lost access to covered property or premises (described location)

This is rather similar to exclusion A.1. The difference is that this is an indirect source of loss that does not or may not involve any loss to any covered property.

|

Example: Jeri Stiltlover’s home is

completely unharmed by the recent flooding of his neighborhood by a swollen

creek. Jeri’s home is novel because it is built upon a set of thick,

six-foot-tall posts. Unfortunately, several sewers collapsed, including the

portion underneath his driveway and the public road in front of his home, so

he must stay in a hotel until repairs are made. The extra meal and rooming

expenses (averaging nearly $80 a day) are not covered by the flood policy. |

|

3. The insured’s loss of use of the insured premises (described location) and/or the covered property

While an insured can suffer genuine economic harm from a flood that prevents an insured from using his property, such loss is indirect; so, it would not qualify as a recoverable loss.

4. Loss resulting from interruption of business, profession or manufacture

Another source of indirect loss is the loss caused by unrealized opportunities. Again, since this is not a direct loss of tangible, insured property, no claim for such losses can be filed under the flood policy. Actually, they can be submitted, they just won’t be honored.

5. Additional expenses that are incurred while the insured building is being repaired or is uninhabitable, regardless the reason

The flood policy is priced to handle direct damages to an insured residence or personal property from flood waters. The policy is NOT structured to pay for higher expenses suffered when a building cannot be used.

6. Any increased cost of repair or reconstruction as a result of any ordinance regulating reconstruction or repair, except as provided in Coverage D – Increased Cost of Compliance

The first thing to do is to review what protection is provided by Coverage D. Otherwise, any legal requirement that adds to the cost to repair or replace a damaged home is not covered. Why is there a need for such an exclusion? The rating for any insurance policy relies upon having solid information about the maximum exposure to loss. Laws or rules that substantially change an insurer’s exposure, without adjusting their premium for the increased exposure, are a threat to an insurer’s ability to provide coverage to all of its customers.

|

Example: Alex

Bracelard’s restaurant is located in the Western Memories Business District

and it was severely damaged by floods caused by days of torrential downpours.

The city just sent him a notice that, since nearly three/fourths of the

restaurant has to be replaced; the city is exercising its building

requirement that the business be rebuilt to mimic the frontier town

architecture used throughout the district. Alex’s flood policy has a limit of

$130,000 and the original loss was estimated at $92,500. In order to comply

with the city’s requirement, a builder estimates a total cost of $124,000.

This additional cost is not covered in the policy, so Alex has to consider

selling his business. |

7. Any other situation that creates economic loss

It appears that this exclusion prevents an insured from filing a claim to recover for any type of financial loss that, while connected or related to a flood loss, is not eligible for coverage under the flood policy.

B. A loss which already exists at the time when the effective date of the flood policy first takes effect. The starting time for coverage is 12:01 A.M. of the first day of the policy period. This same stipulation exists concerning any increase in coverage that is requested. Neither coverage, NOR a higher limit of coverage, apply to a flood loss that has already occurred.

|

Example: Jim's

Gymnastics has a new flood insurance policy with a limit of $115,000. Jim's

business is experiencing severe flood damage due to wide-spread,

storm-induced run-off. The flooding began on September 18, 2017. Jim’s new

policy has effective dates of September 22, 2017 through September 22, 2018.

The water subsides on September 28th. Unfortunately, because at the time the

policy took effect the business was already flooded, the loss is not covered. |

C. Losses involving

earth movement. Examples of earth movement are the following:

· Earthquake

· Sinkholes

· Land destabilization or movement caused by underground water accumulation

· Gradual erosion

· Land subsidence

· Landslide

An exception is made for the limited types of earth movement which ARE covered. You must refer to the definition of flood in order to understand this exception.

|

Example: In certain instances, damage

from mudflow is eligible for flood coverage. |

Related Court Case: “Water–Caused Soil Movement Held To Exclude Dwelling Flood Damage Claim”

D. Losses involving

other causes, including:

1. Weight or the pressure of

ice.

2. The effects of freezing and thawing

3. Rain, snow, sleet, hail or water spray

Policyholders under the flood program have to look elsewhere for damage caused to their property from these perils. The flood policy’s rating is designed for covering its definition of the flood hazard.

4. While the flood policy does provide coverage for damage caused by

flooding, it does not cover losses involving any if the following:

· Water

· Moisture

· Mildew

· Mold

This is the case IF:

· The loss is a result of a condition that is confined to the described location. A flood that is only at the insured’s location is NOT covered. The definition of flood requires a more widespread water loss.

· The condition is under the insured’s control. Circumstances that may be considered to be under an insured’s control are: defects in design or structure, mechanical deficiencies, failure or stoppage; as well as broken water lines, pumps, sewer lines, drains, fixtures or equipment.

5. The flood policy does not cover damage from water or water-borne material

seepage, sewer backup or sump pump backup. However, if flood that is in the

area and is the proximate cause of such activities, it is covered.

6. The pressure or weight of water UNLESS such damage is due directly

from flooding.

Related Court Case:

“Collapse Of

7. The flood policy normally excludes flood losses which are due to the failure of a covered property’s heating, cooling systems or of its loss of power. HOWEVER, such losses can qualify for coverage when it is an eligible flood physically damages power, heating, or cooling equipment on the described location. This means that no coverage is available when the flood at an off-site premises caused the failure.

|

Example: A businessowner suffers a serious loss to

his equipment because a pump located in his office's basement fails over the

weekend while his business is closed. The unpumped water reaches the first

floor. At first the claim is denied. However, upon investigation, it’s

discovered that the flood waters short-circuited the pump’s power supply,

causing the water to accumulate. In this instance, the flood damage is

covered. |

|

8. Loss from theft, fire, explosion, wind or windstorm is not covered.

This is a logical exclusion because the flood coverage is meant to dovetail with other policies that respond to non-flood sources of loss to insured property.

9. A loss caused intentionally by the insured or any person on the insured’s

behalf (agent).

This exclusion makes sense as it is based upon the very foundation of insurance coverage: that the loss be accidental in nature. Creating a loss on purpose is the ultimate slap in the “face” of an insurance policy and is, understandably, excluded.

10. A loss caused by the insured’s modification to the insured property

which materially increases the risk of flooding.

|

|

Example: Prudy Mylawn’s passion is

taking care of her garden and landscaping. Prudy and the subscribers to her

dating club also love their privacy. An attraction that her customers like is

the solid wood plank fencing around three sides of her dating club premises.

She loves how the new fence contrasts with the gentle, downward slope of the

land in the rear of her club. It was even worth ignoring the fence

contractor’s suggestion to raise the fence several inches off the ground.

After a particularly heavy spell of wet weather, Prudy is upset when, not

only is there a lot of standing water in her yard, the water backed-up into

her club, ruining carpeting and oaken flooring. Unfortunately, the damage was

due to her fence trapping the rainfall, so the damage is not covered by her

policy. |

E. Finally, there is

no coverage for flood damage to any property that is located on property that

is leased from the Federal Government under the following circumstances:

· The property has been flooded by the Federal Government

· There is a hold harmless agreement that relieves the government from liability under the flood policy

Further, in the above situation, no claim can be made for any indirect losses or expenses related to the property being flooded.

VI. Deductibles

The method for applying deductibles under the general property policy is essentially as straightforward as what is found in most other types of policies. Any payment under the policy is net of the deductible amount that appears in the policy declarations. However, there are two notable differences between the general property deductible provisions and those of other forms.

A. The stated deductible increases substantially under a certain circumstance. If a loss occurs to a covered building that is in the course of construction, the applicable deductible may double. A doubled deductible applies if the covered structure does not have a minimum of two sturdy exterior walls and a secured roof when a loss occurs. The higher deductible appears fair. An insured should bear a greater amount of the flood loss exposure during the time that the property is in a much more vulnerable condition.

B. The stated deductible applies separately to a covered building and covered personal property.

|

Example: There is a flood loss with the following results: |

||

|

Property Affected |

Loss Amount |

|

|

Building Damage |

$12,000 |

|

|

Contents Damage |

$9,500 |

|

|

Total Loss |

$21,500 |

|

|

In this case, a $1,000 deductible applies. According to this provision, the deductible would apply as follows: |

||

|

Property Affected |

Loss Amount |

Deductible |

|

Building Damage |

$12,000 |

$1,000 |

|

Contents Damage |

$9,500 |

$1,000 |

|

Totals |

$21,500 |

$2,000 |

|

In this case, the total settlement would be $19,500. |

||

C. There are two instances when a deductible is not applied: when the loss involves either Loss Avoidance Measures and/or Increased Cost of Compliance.

|

Example: Again, we have a business suffering a flood loss with the following result: |

|

||

|

Property Affected |

Loss Amount |

Deductible |

|

|

Building Damage |

$12,000 |

$1,000 |

|

|

Contents Damage |

$9,500 |

$1,000 |

|

|

Loss Avoidance expense |

$1,300 |

N/A |

|

|

Increased compliance costs |

$5,000 |

N/A |

|

|

Totals |

$27,800 |

$2,000 |

|

|

The change in loss circumstance, with a significantly higher loss amount, has no effect on the total deductible. The result is that, overall, the impact of the deductible decreases. |

|||

VII. General Conditions

This section contains items that, generally, affect the entire policy. For the most part, they concern either coverage or contractual issues.

A. Pair and Set Clause

If an article which is part of a pair or set is lost, the carrier has the option of paying an amount equal to the cost of replacing the lost article, less depreciation, or an amount which represents the fair proportion of the total value of the pair or set that the lost article bears to the pair or set.

This provision gives an insurer the flexibility of handling the loss of such an item as individual property. Yes, the insurer tries to settle the loss while considering the fact that a piece is part of a pair or set. However, the insurer is not obligated to automatically settle such losses as though the insured has lost the full value of the pair or set.

B. Concealment, Fraud

and Policy Voidance

1. This policy is voided, will become ineligible for either renewal or replacement if any insured or its insurance agent has done any of the following regarding this particular policy or any other NFIP insurance:

· Lied about or concealed any material fact

· Committed any fraudulent act concerning this insurance

· Made a false statement

Insurance policies are contracts where the party providing the insurance protection is highly dependent upon an applicant for information concerning the insurance-worthiness of their property. The NFIP is so sensitive about this contractual issue that, unlike most property and casualty programs, the application is made into a legal part of the insurance contract. An applicant who decides to either hide or lie about information that would affect the insurer’s decision to accept or properly rate a flood policy faces the prospect of losing their coverage, even at the time of a loss.

|

Example: Ig Noble has just bought

rental property from a friend who tells him that he needs to tear down the

solid wood fence that borders the back and side yards. The seller/friend says

that the fence doesn’t allow water to drain during very heavy rains and that

his property was almost flooded several times from backed-up water. Ig

decides to ignore the friend’s warning because he likes the fence and he

thinks that the drainage situation will improve when he changes the

landscaping. Ig doesn’t think he needs to mention the situation when he

applies for a flood policy. Several months later, while investigating a flood

loss (surprise… from backed-up water), Ig’s agent finds out about the fence

and drainage problems and tells the insurer. The insurer voids the policy and

denies coverage for the $9,500 loss. |

2. If a policy is voided, the move takes place as of the wrongful act.

3. A party whose policy is voided also faces the punishment of not being eligible for reinstating, renewing or replacing the coverage. Further, proof of any fraud may also result in a guilty person being fined or even jailed.

4. Coverage may also be voided for other reasons such as the property being of a type that is not eligible for coverage under the NFIP. Another voidable reason? If, at the time the policy was written, it was part of a nonparticipating community and, subsequently, the community does not join or reenter the NFIP prior to a loss.

C. Other Insurance

1. If a loss that is covered by this policy is also covered by other insurance, whether collectible or not, the insurer is obligated to pay no more that would be covered under this policy. It is limited to the proportion of the loss that the limit of liability which applies under this policy bears to the total amount of insurance. However, this proportion amount applies only if neither of the following applies:

· If there is other insurance in the name of the insured covering the same property protected by this policy that states it is excess, then this policy is primary and the proportionate sharing does not apply.

· This policy is primary but the deductible amounts differ. After it meets is own deductible it alone pays until the deductible of the other insurance is satisfied. Once the other insurance’s deductible is met, all losses are then shared in the proportion the remaining limit on this policy bears to the amount of insurance that remains available from both policies.

This provision is similar to those found in other types of insurance policies. It is intended to take the existence of other sources of coverage into consideration when determining loss payments. This preserves the larger goal of not permitting individuals to “profit” from insurance and to protect the flood program’s capacity by restricting it to provide only its share of coverage to an eligible loss.

2. If this policy is issued to a condominium association and a covered loss occurs to a condominium unit owner who has separate flood coverage, this policy responds on a primary basis.

Note: This provision is triggered regardless of whether another source of coverage is collectible. On its face, this would mean that the amount of coverage under the flood policy would contribute on a proportional basis even if another source can’t be collected.

D. Amendments,

Waivers, Assignment

This policy cannot be amended nor can any of its provisions be waived without the express written consent of the Federal Insurance Administrator. No action taken by the insurer under the terms of this policy can constitute a waiver of any of its rights.

The named insured has the right to transfer this policy to another if the transfer in done in writing. The transfer will take place at the same time as the transfer of title. This right is NOT permitted if the building is in the course of construction or if the policy applies only to contents.

This condition is unique in that a named insured can assign its policy to the entity purchasing the property insured under this policy without prior notice to the insurance company. Most insurance policies do not permit any assignment of coverage due to the need to specifically underwrite the named insured insured. However, problems can arise.

|

Example: Kleer

Forsyte purchased a flood policy as soon as he started to build his new

flower shop. However, even Kleer didn’t foresee his wife's sudden transfer

from Soggyville to her company’s home office in Dryerplace. Kleer’s flower

shop partner, Gona Stayputt, buys the “shop-in-progress.” Kleer believes he

is permitted to have the flood policy

assigned over to Gona. Much later in the year, after the shop has been built

and Gona has begun business, there’s a flood loss. The adjuster says that the

flood claim is denied because Kleer could not assign the policy to Gona because

the building was in the course of construction at the time of the assignment. |

|

E. Cancellation of

Policy by You

An insured under the general property flood policy may choose any time to cancel his or her coverage. Any refund will be handled according to NFIP rules.

F. Nonrenewal of the

Policy by Us

Coverage will not be renewed if the community where the covered property is located no longer participates in the National Flood Insurance Program or if the covered building is classified as ineligible.

G. Reduction and

Reformation Coverage

1. Either before or after a loss occurs, the insurer may discover that they did not receive the correct premium due on the policy. The discovery may be obvious, such as the insured failing to send in the full premium; or it can be subtle, caused by an error or oversight in policy rating. In such instances, the policy coverage can be reduced to the level that coincides with the level of full-term coverage that could be purchased with the amount of money actually received.

2. Once the problem is discovered, the insured will get a notice to send in the additional premium. If the additional amount is received in time, coverage will be reformed to supply full–term coverage at the original amount requested or, if the discovery occurred after a loss, settlement will be made according to the full amount of initial coverage. If the additional amount is not received in time, coverage will continue at the reduced amount or, if applicable, the loss will be settled according to the reduced amount.

A notice of additional premium due is also sent to any mortgagee or trustee that appears on the policy. That party may take advantage of having the coverage reformed by making the payment. However, such a party only has 30 days from the time of receiving the notice to do so.

Note: If a mortgagee or trustee exercises this right, the benefit only applies to that party.

This item is a commendable feature of the policy. Traditionally, insurers that receive inadequate premium arrange to use the premium received as a paid–up amount and then terminate coverage. The flood policy treats such payments differently. Instead of terminating coverage, the coverage is kept in force, but according to the amount of coverage supported by the lower premium amount.

|

Example: Bea Shortpay bought a flood

policy. The insurance limit on her store was $89,000. Bea’s premium payment

was discovered to be inadequate to cover the full amount. Bea received notice

that additional premium was due. If Bea doesn’t make an additional payment,

her coverage is reduced to $81,000. |

Note: Any coverage adjustment MUST conform to the minimum amount of coverage permitted by federal regulations. Again, it is worth mentioning that, since there are several references to the Code of Federal Regulations (CFR), it would be helpful if this information were included with the policy, if not in full, at least the pertinent excerpts.

Exactly what happens when an insured doesn’t pay the full premium? The following is the basic order of events:

1. The insurer discovers that the premium payment is insufficient

2. An additional billing is sent to the insured

3. The insured has 30 days from the date of the written additional premium notice to send payment

4. If payment is received in time, coverage is restored according to the amounts originally requested

5. The coverage restoration is effective either on the inception date of the policy term or, in the case of an endorsement form, the endorsement’s effective date.

If the insufficient premium is discovered before a loss, the additional premium billing is for the current policy term or, if applicable, the full endorsement term.

If the insufficient premium is discovered after a loss, the additional premium billing is for the current policy term as well as (when applicable) the PREVIOUS policy term or, if applicable, the full endorsement term.

Note that an additional financial interest in the flood policy, such as a mortgagee or trustee, ALSO receives a 30-day notice of the additional premium due. The right to reforming coverage for the additional interest is limited to increasing the coverage to meet the total amount of indebtedness rather than the original amount requested.

However, it is not clear whether this provision only applies in cases where the outstanding debt is LOWER than the amount of coverage requested and would be limited to the coverage amount originally requested if, by some circumstance, the mortgage or loan amount were the higher amount.

3. What happens if the insufficient premium was due to the insurer finding out a material misrepresentation or concealment that affects the policy coverage? In such instances, the policy is not subject to reformation and an additional billing notice, but rather voidance of coverage is triggered.

H. Policy Renewal

1. This condition tells an insured that he or she has to take the bulk of responsibility for keeping the flood insurance in force and to pay careful attention to the policy effective dates that appear on the policy declarations page. Coverage for a given policy term expires on 12:01 a.m. on the last day of the policy’s term.

2. In simplest terms, the insured has to pay the renewal premium within 30 days of the policy expiration date or coverage ends as of the policy’s expiration date. In the event that a payment is BOTH received and accepted by the insurer, a renewal policy will be sent to the insured.

3. If the insurer has either failed to send a renewal notice before the policy expiration or it used an errant address that delayed proper delivery prior to a renewal date, the following procedures will be followed:

· If, within a year from the policy’s expiration date an insured or his agent tells the insurer that they never received a renewal notice and the insurer is able to confirm that a notice was not received, the insurer will send a second billing notice.

· The second notice will have a separate 30-day grace period. If it is paid in time, the coverage will renew. If it is not paid, the policy remains expired.

4. Recertification – An insured may be required to confirm that all of their rating information is still correct. The insurer uses a Recertification Questionnaire for this purpose.

This is a harsh condition. It states that the flood policy will NOT pay for a loss that occurs after an insured either knows about or is responsible for an increase in the property’s vulnerability to flooding.

J. Requirements in

Case of Loss

Should a flood loss occur to the insured property, the following actions must be taken by the named insured:

1. Notify the insurer in writing promptly

2. As soon as reasonably possible, separate the damaged and undamaged property, putting it in the best possible order so that the insurer may examine it

3. Prepare a complete inventory of the damaged property. The inventory has to describe all quantities, descriptions, loss amounts and ACV of each item, along with any documentation (i.e., receipts).

4. Within 60 days following the loss the proof of loss must be sent to the insurer. A valid proof of loss is a written statement about the amount being claimed under the policy. This document must be signed by the insured and it is a sworn statement which must include the following information:

a. The date and time of the loss

b. An explanation that can be brief about how the loss happened

c. The named insured’s (financial) interest in the property damaged and any other interests in the damaged property.;

d. Details about any other insurance covering the property. This means the named insured is required to fully disclose all information on any other source of coverage. The insurer wants to be in the position of deciding on whether other sources apply. The policyholder is not to make this decision.

e. Details of any changes in ownership, use, occupancy, location or possession of the insured property since the policy was issued

f. Building specifications and repair estimates

g. Names of mortgagees or all others who might have a lien, charge or claim against the property insured under this policy h. Details about whoever was occupying occupied any insured building at the time of loss. This should include the purpose for which it was being occupied.

i. The inventory of damaged property as explained in item J. 3 above.

5. Document the loss with all related bills, receipts, and similar documents for supporting the amount being claimed. The named insured is to use its own judgment in determining the amount of loss but then justify it.

Related Court Case: “Proof of Loss Not Submitted In Time, Flood Loss Not Covered”

6. The named insured is required to cooperate with the adjuster or representative as they investigate the claim.

Note: Under item 7. which follows, although the insurer supplies an adjuster to handle the loss, this person has very limited authority; this is especially true regarding questions about the eligibility of the loss for coverage under the policy.

7. The adjuster investigating the claim may provide a proof of loss form and may help in its completion. However, this is a matter of courtesy only, and the insured still has the responsibility to send the carrier a proof of loss within 60 days after the loss even if the adjuster does not furnish the form or help in its completion.

Related Court Case: “Loss Reported, But Not In Required Manner”

8. The adjuster is not authorized to approve or disapprove claims or guarantee whether the claim will be approved.

|

Example: Val and Mal Adjustid’s home

was severely damaged by a recent flood. Soaked Soil Ins. Company sent Larry

the adjuster to handle their claim. Val, Mal and Larry spent a couple of days

looking at the damage around their home and studied the damage to their

personal property. Larry gave the Adjustids a proof of loss statement. The

statement was thorough and included receipts. The Adjustids mentioned in the

statement that they relied totally upon Larry’s expertise in claiming a loss

of $23,000 on their personal property and $52,300 on their home. Soaked Soil

Ins. sent the Adjustids a polite, but firm denial of the claim until they

send a proof of loss statement that reflects their own assessment of the loss

amounts. |

9. This item is the complete opposite of item 7. The insurer may choose to waive the requirement that the insured files a signed proof of loss statement. Instead, the insured may be required to sign and swear to an adjuster's report of the loss which includes information about the loss and the damages sustained. The company will rely on the adjuster’s report to handle the claim.

K. Our Options after

a Loss